If you have an underperforming No-Lo practice, here’s how to fix it.

Don’t settle for low profitability—now or when you are ready to sell your business. If your practice is not generating as much profit as you would like—or if it’s an underperforming No-Lo practice (one that has no or low profit)—evaluate how your numbers stack up to industry benchmarks, and start whittling away at what’s eroding your profits.

“There’s nothing harder for a practice evaluator than to deliver a message that the practice you thought was worth $2 million is only worth $300,000,” says Denise Tumblin, a CPA with WTA Veterinary Consultants.

What’s more, says Tumblin, low profitability affects the quality of your life and business long before you are ready to retire. Tumblin and CPA Glenn Hanner of Whitley Penn suggest ways to fix a No-Lo practice:

1. Review financial benchmarks. Are you hitting the mark with cash flow and profitability? The lower the cash flow, the lower the value, Tumblin notes. In fact, each dollar of cash flow adds $3 to $6 of value. Profit for well-managed practices ranges from 15% to 18%, while a No-Lo practice dips to less than 8%. Low profitability affects how much you can invest in your business today, and it will have a profound impact on your practice value down the line.

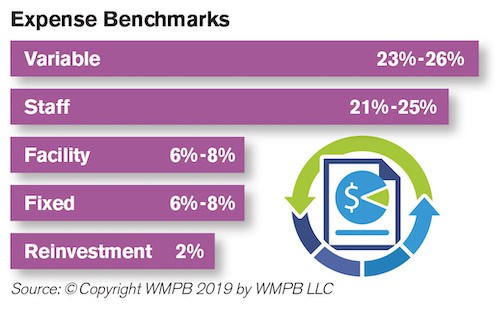

2. Analyze expenses. Variable expenses including drugs, medical supplies and merchant fees, should range from 23% to 26% of your revenue, says Tumblin. Staff expenses should come in at 21% to 25%. Both facility expenses (rent, property taxes, utilities, repairs) and fixed expenses (advertising, telephone, health insurance) should fall between 6% and 8%.

2. Analyze expenses. Variable expenses including drugs, medical supplies and merchant fees, should range from 23% to 26% of your revenue, says Tumblin. Staff expenses should come in at 21% to 25%. Both facility expenses (rent, property taxes, utilities, repairs) and fixed expenses (advertising, telephone, health insurance) should fall between 6% and 8%.

“When fixed expenses are high, it’s usually a revenue issue,” advises Tumblin. “We’re not producing enough revenue to support the overhead we have.” If you’re in a new facility, your facility expenses may temporarily hit 12% to 15%, but “over time you need to get back into the 6% to 8% range,” says Tumblin.

3. Get inventory management on track. Among inventory, heartworm and tick products should be 3% to 5% of revenue, and food costs should be about 70% of your food sales. Review pricing, potential missed charges, overstocking, and use of your online pharmacy. If your numbers are not in line with industry benchmarks, reach out to your PSIvet Practice Consultant for assistance with inventory management.

4. Review staff compensation. Are your doctors producing enough to support their compensation and benefits? And do they have enough technician support? This is another area that warrants a critical look, says Tumblin. Annual medical revenue per doctor should be in the $650,000 to $850,000 range, she estimates. And the more technicians you have, the higher that production will be. “Each additional technician gives the doctor the ability to produce another $100K in revenue,” she says.